Not known Facts About Will My Insurance Be Affected When Filing Bankruptcy

The moment your creditors conform to a buyer proposal, it really is binding, meaning that they cannot alter the terms Down the road.

Just before filing for bankruptcy, it’s essential to evaluate your insurance protection and make knowledgeable choices. Assessment all current insurance procedures, like wellbeing, everyday living, auto, and assets insurance. Have an understanding of what protection you've and regardless of whether any policies need to be updated or managed over the bankruptcy approach.

You may additionally be needed to have a clinical Test and supply your professional medical heritage when buying a new daily life insurance plan — although the policy wouldn’t need this sort of details from folks with out bankruptcy inside their background.

On the other hand, it’s vital that you seek advice from with a lawyer or monetary advisor who focuses on bankruptcy to grasp the precise regulations and restrictions in your jurisdiction.

To safeguard your daily life insurance passions, you’ll need to be aware of what type of passions you've, their values, whether or not they’re section within your bankruptcy estate, and whether or not they’re exempt from liquidation.

They can offer insights on specialized insurance items that are built especially for folks dealing with bankruptcy.

But, In the event your employer does have additional great good reasons for using People steps, such as dishonesty, incompetence, or often remaining late for perform, the fact that you do have a bankruptcy won’t help your bring about.

Chapter 7 bankruptcy is also called liquidation bankruptcy. It requires promoting belongings to repay creditors, and any remaining debts are discharged, or eradicated. In exchange for possessing Extra resources your debts discharged, you could be required to surrender sure belongings for being sold — Those people resources will then help repay creditors.

Deductibles: Assess your deductibles to determine if they are continue to manageable for the latest economic YOURURL.com scenario. Modifying deductibles can effect your rates, so uncover the ideal stability that works in your case.

All our clients can contact our helpdesk at any time. We endeavour see this here to reply asap to all who Make contact with us.

When your employer is by now garnishing your wages and Then you definitely file for bankruptcy, the employer will learn go to this web-site about it. Your employer will be notified with the bankruptcy for that uses of putting a end about the garnishment.

This contains such things as luxurious objects, next residences, and financial investment Attributes. You might be able to preserve essential products like your automobile and first home, but this relies on the worth on the house and whether you’re current on payments.

A discharge of debts happens when a debtor is lawfully relieved in the obligation to pay specified debts just after bankruptcy proceedings. In Chapter seven bankruptcy, this discharge usually occurs speedily once the liquidation of belongings. In Chapter thirteen, the debtor need to comprehensive a repayment system ahead of the debts are discharged.

The target of bankruptcy is to offer a clean commence for individuals or companies burdened with debt they can't pay out. There are numerous varieties of bankruptcy, but the try this most common are Chapter seven and Chapter 13.

Jaleel White Then & Now!

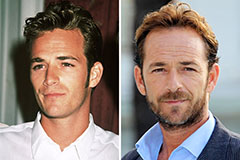

Jaleel White Then & Now! Luke Perry Then & Now!

Luke Perry Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!